ACCUMULATING WEALTH

3 Keys To Accumulating Wealth

Time and Consistency

Time & Consistency

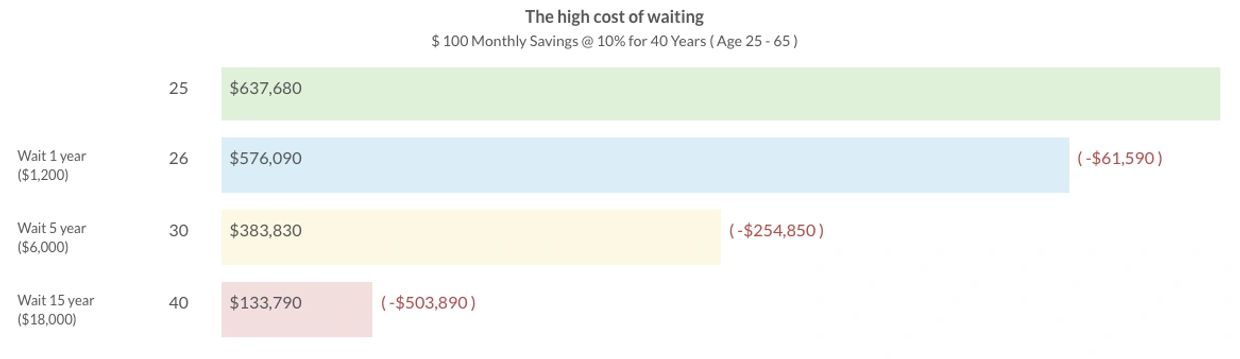

Having your clients set aside money on a regular basis, and doing it as early as possible, can have a tremendous impact on their accumulation value. The chart above shows how as little as $100 a month can grow, given enough time. It also demonstrates the high cost of waiting.

Rate of Return

Rate of Return

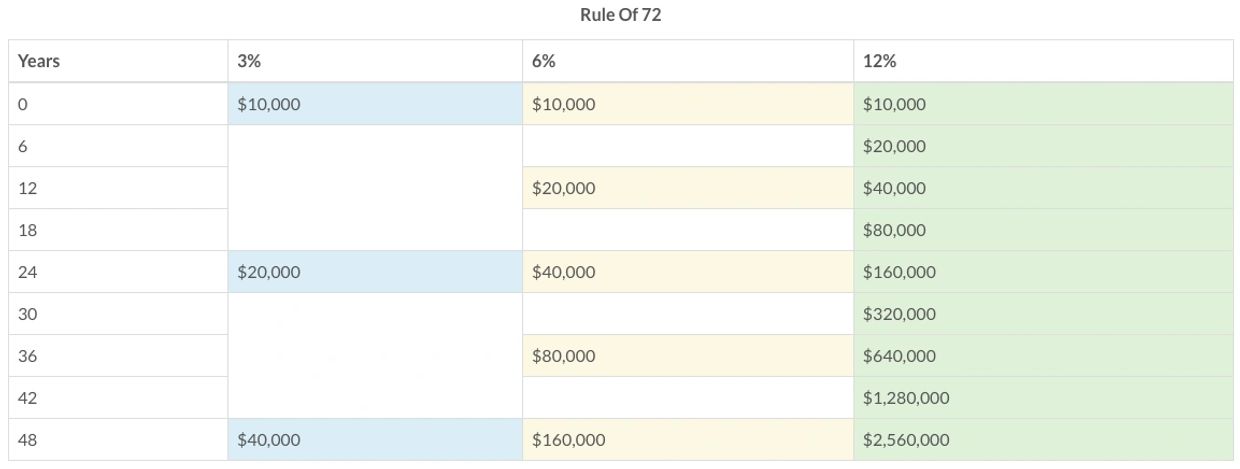

Many of your clients will spend unlimited time trying to save a quarter percent on their 30 year mortgage. While they understand how big of a difference that makes over 30 years on their mortgage, they don't always apply that when trying to accumulate wealth. The Rule of 72 says if you divide 72 by your rate of return, that tells you approximately how long it will take your money to double. If you average an 8% return on your accumulation, your money will double every 9 years.

The chart above illustrates why your clients need to strive for the best return possible.

Minimize Losses

Minimize Losses

Nothing disrupts consistency or rate of return, like a 30 - 40% loss on your client's accumulation value. Equally important, your client needs to understand the return necessary, just to get back to where they were. If they suffer a 50% loss, they need 100% gain, just to get back to even. The chart above shows the true impact of losses on an accumulation account.

Money Management

Noble Marketing Partners, LLC are strong believers in actively managed money.

Until recently, many managers have required $100,000 - $250,000 to open accounts. Now, through Registered Investment Advisors (RIA's) and their Investment Advisor Representatives (IAR's), they've been able to bring Wall Street to Main Street.

While we are non captive, and you are free to associate with the Broker Dealer or RIA of your choosing, we highly suggest looking at First Advisors National, LLC (FanAdvisors). At FanAdvisors you have:

- Accounts that can be opened for as little as $100 a month.

- A low fee, full fiduciary 401K for businesses of 10 or more employees.

- Access to 403b and 457 plans

- Low fee annuities with nearly 400 investment options

- Top money managers, with the ability to add more.

- Total fees of $75 a month, including licenses, which are deducted from commissions.

Contact us for more information about the NMP/FAN partnership.

Investment Advisory Services Offered Through First Advisors National Investment Advisors, LLC (FANAdvisors). Noble Marketing Partners, LLC and First Advisors National Investment Advisors, LLC are separate entities which do not offer legal or tax advice.